What is Income Protection?

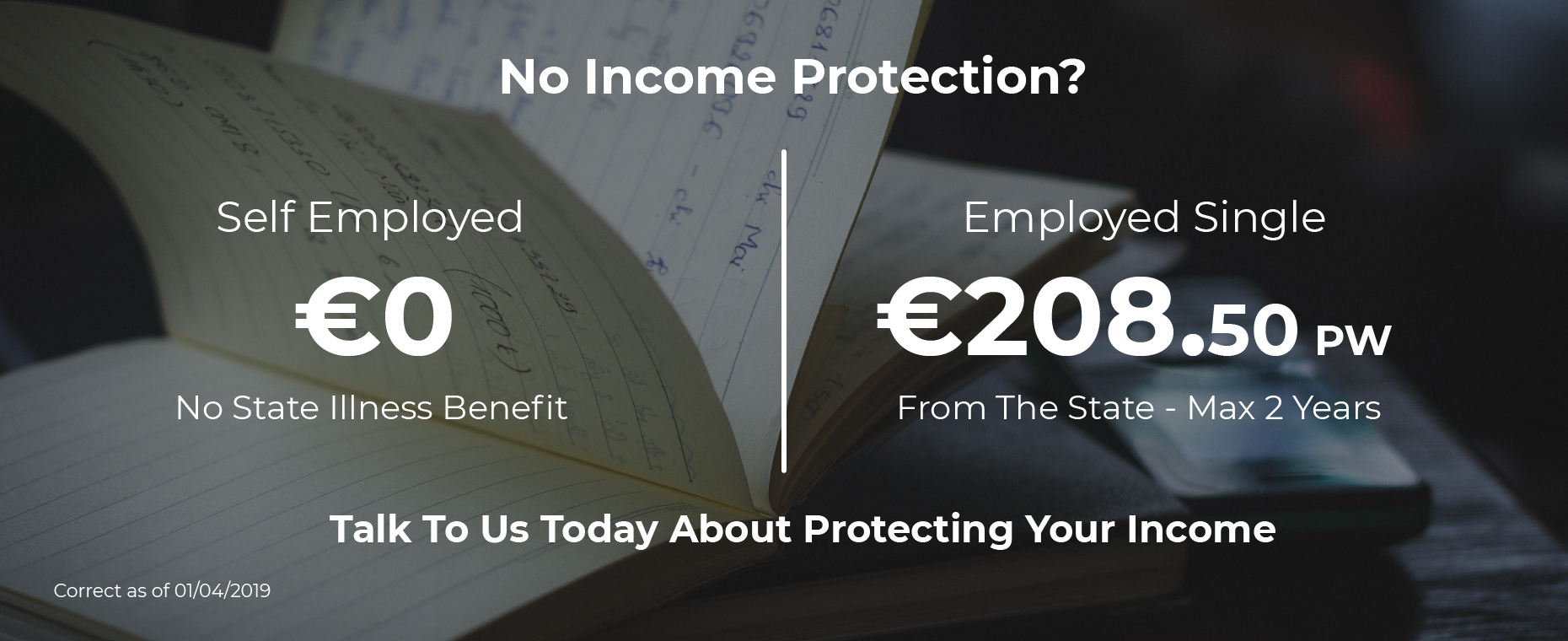

Put simply, Income Protection protects your income. If you’re off work long-term because of illness, injury or accident, Income Protection provides a monthly income to safeguard your lifestyle. Income Protection provides you with the reassurance that you have a properly organized back up plan – and the cost is tax deductible too.